A former student asked: “Can you make a thought-piece on this news article? [Link here] I was looking at the comment section and I do not understand a lot of what is being claimed. If you could clarify the economic root(s) of this issue, I would appreciate it. If not for whatever reason, that’s fine. Thank you.”

That left a lot of ground to cover, so I asked for some more specific questions, which ensued, and are blockquoted here so I can finally answer some of his questions by blowing through them post-haste. I numbered them for convenience’s sake.

[1] How much of Jacksonville’s housing situation has to do with national inflation versus more local factors like population increase and companies buying up properties solely for rentals?

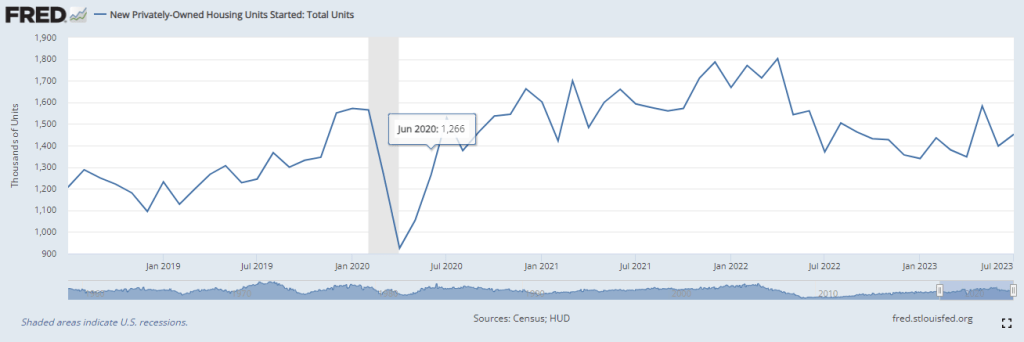

I don’t know how much of the increase is due to local factors rather than inflation, mostly because I haven’t done any econometrics since the first Clinton administration. But Florida’s population is growing faster than the national average, so it stands to reason that local factors account for more of Jacksonville’s increase than they do for most of the rest of the country. Another factor might be a slight slowdown in housing starts (i.e., new construction). I don’t have local information handy, but looking at this national graph from the St. Louis Fed…

…it looks like housing starts recovered from the lockdowns by mid-to-late-2020, went up a bit until spring of 2022, and have dropped off a bit since then. So the slow-ish supply is likely contributing to higher prices, too.

[2] Is the solution to simply let the market work itself out?

[…]

[6] How much should government intervene if at all?

Sowell tells us that there are no solutions, only trade-offs. Markets usually manage trade-offs better than governments do. I say “usually” instead of “always” because government has to handle some things better than markets do, right? Doesn’t it? But then usually government screws up the trade-offs, too.

Someone might point out “insanely massive firms buying up as many houses as possible with that pandemic money” as an instance in which government must intervene, but if so, that seems like “government trying to fix its own mistake” rather than “government fixing the market’s mistakes.” I don’t know exactly how to fix that one, but “not giving those firms helicopter cash” seems like a good start.

You know what? Keep it simple: let the markets decide how much housing is built, how much is owned, how much is rented, etc. I know it’s politically popular to push for high home ownership levels, but I’m less and less convinced that the economic advantages of home ownership dramatically outweigh the advantages of renting. There’s no apparent optimum level of either, so government shouldn’t try to achieve one.

What should the government do? Stabilize the dollar so that mortgage rates are driven by real interest rates instead of by inflation. The closer inflation is to zero, the more easily you can figure out whether high housing prices are driven by market forces, and the more easily you can answer question [1] above.

[3] Is there going to be another major housing crisis?

Yes. When? I don’t know.

[4] What role do banks and realtors play?

They primarily try to optimize their profits, and lobby governments for policies favorable to themselves. Whether those policies benefit owners and renters is secondary. But if humans aren’t buying and renting homes, then the banks and the realtors can’t make money*, so there’s an incentive to make sure at least some folks have roofs over their heads. More specifically, there are incentives to make sure that prices are high and/or the quantity of sales is high. But that’s no different from any other market.

[5] Do more houses need to be built?

Maybe. It’s possible the market is signaling a need for more housing and starts, but it’s also possible the actual numbers of houses and starts are fine and there’s just too much cash chasing them. I don’t know which is more right.

[7] How much does the minimum wage issue matter here considering the rapid inflation?

Errrrrrrrrrrrrrrrrmmmmm this is something I haven’t thought about in a long time, but I think conventional wisdom about minimum wage is a bit off in several regards. It warrants its own post. But to answer your question quickly, raising the minimum wage will not resolve housing policy problems, and minimum wage is not causing housing problems (except maybe very indirectly).

I’d like to say that better financial literacy education would mitigate many of these problems, but the trick would be getting students to pay attention, and even if they do, financial literacy often goes right out the window when politicians play with other people’s money.

A few other items were asked about in the email, but I’ll address them another time. I hope this helps a bit.

…

* Of course, there are always bailouts. Bailouts probably aren’t great for the market, but they are presumed to stave off the torches and pitchforks.